Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

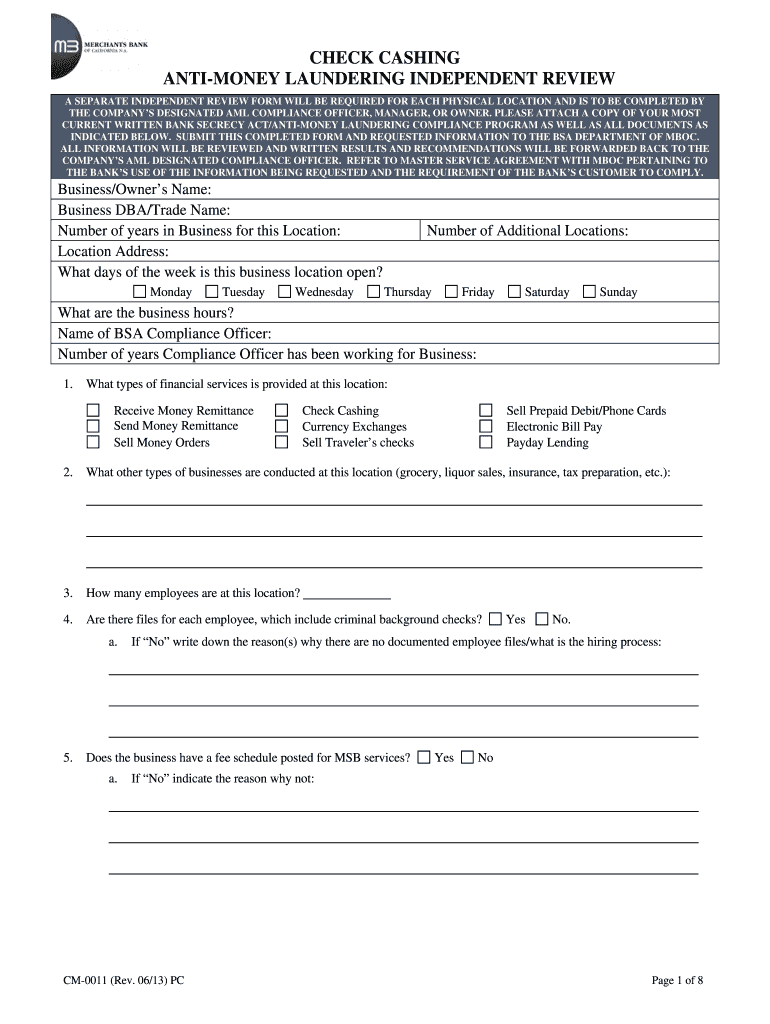

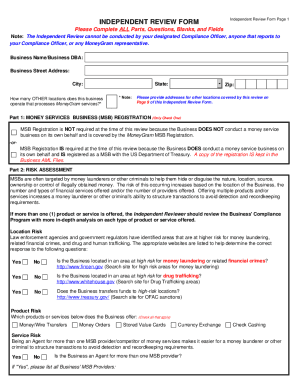

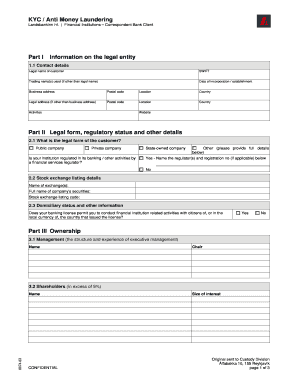

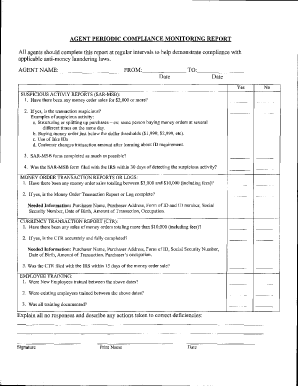

Who is required to file aml independent review template?

The Financial Action Task Force (FATF) recommends that all financial institutions, including banks, securities brokers and dealers, money services businesses, and casinos, complete an independent review of their anti-money laundering (AML) systems and controls. The independent review should be conducted by an independent and qualified party, such as a third-party consultant or a professional services firm.

How to fill out aml independent review template?

1. Read the AML Independent Review Template and understand the purpose of the review.

2. Identify the relevant AML requirements that the review will focus on.

3. Gather and review relevant documents related to the AML requirements, such as customer due diligence documents, suspicious activity reports, and transaction monitoring reports.

4. Determine the scope of the review and any specific areas to be examined.

5. Create a plan for the review, including timelines and objectives.

6. Document the review findings and any gaps or deficiencies identified.

7. Make recommendations for improvements to the AML program based on the review findings.

8. Prepare a report summarizing the review and any recommendations for improvement.

9. Submit the report to the appropriate stakeholders.

What information must be reported on aml independent review template?

The information required to be reported on an AML Independent Review Template may vary depending on the requirements of the regulator, but generally includes:

• A summary of the purpose of the review

• An overview of the scope and objectives

• A description of the methodology used

• A description of the findings

• A list of recommendations

• A description of any corrective actions taken

• A timeline for completion of the corrective actions

• A description of AML controls in place

• A summary of any monitoring activities conducted

• A summary of any third-party reviews conducted

• A summary of any training and/or education conducted

• A summary of any reporting obligations met

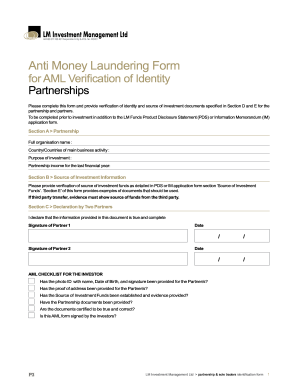

What is aml independent review template?

An AML (Anti-Money Laundering) independent review template is a standardized document or form that is used to conduct and document an independent assessment or review of an organization's anti-money laundering program. This template outlines the key areas and elements that should be covered during the review process, such as policies and procedures, risk assessment, customer due diligence, monitoring and reporting, training and education, and internal controls. It helps to ensure that the review is comprehensive and consistent across different organizations or entities, and allows for proper documentation and reporting of any findings or deficiencies identified during the review.

What is the purpose of aml independent review template?

The purpose of an AML (Anti-Money Laundering) independent review template is to provide a structured framework for conducting a comprehensive review of an organization's AML compliance program. It serves as a guide that helps independent reviewers assess the effectiveness of an organization's AML policies, procedures, and internal controls. The template outlines various areas to be examined, such as customer due diligence, transaction monitoring, suspicious activity reporting, training, and internal reporting mechanisms. By using an independent review template, organizations can ensure that all required components of an AML program are thoroughly evaluated, and any gaps or weaknesses can be identified for remediation.

What is the penalty for the late filing of aml independent review template?

The penalty for late filing of an AML (Anti-Money Laundering) independent review template can vary depending on the jurisdiction and applicable regulations. In many cases, regulatory authorities may impose monetary fines for non-compliance. These fines can range from a fixed amount to a percentage of annual turnover or assets of the entity involved. Additionally, repeated late filings or non-compliance may lead to further penalties, sanctions, or legal consequences, including potential license revocation or suspension for financial institutions. It is important to consult the specific regulations and guidelines applicable to your jurisdiction for accurate and up-to-date information on penalties for late filing of AML independent review templates.

How can I manage my aml independent review checklist directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your aml independent review template form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my independent review form in Gmail?

Create your eSignature using pdfFiller and then eSign your independent review checklist immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out aml checklist template using my mobile device?

Use the pdfFiller mobile app to fill out and sign independent review template form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.